Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

Style variation

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Buying a home.

- Thread starter Bob Hubbard

- Start date

Price includes washer, dryer, stove and fridge. Furnace and HW heater are 3 years old, roofs 11.

Kitchen does need some help... I'd have to guess who ever "designed" it when it was redone didn't really plan to cook in it. Looks like your work "triangle" is more like a line.

Start to budget for redoing the roof fairly soon (3 to 5 years), I suspect, based on age alone. Depends a little on the job that was done, but I figure that Buffalo winters aren't gentle on roofs...

Start to budget for redoing the roof fairly soon (3 to 5 years), I suspect, based on age alone. Depends a little on the job that was done, but I figure that Buffalo winters aren't gentle on roofs...

from the ground the roof looks pretty decent, but the inspector will eyeball it. Docs say it's a 30 year roof and was a full tear off and plywooding when they did it.

Kitchen, yeah...sink position isn't optimal, and no dishwasher. But that's not super hard to resolve later. Lots of room for a floating island.

Kitchen, yeah...sink position isn't optimal, and no dishwasher. But that's not super hard to resolve later. Lots of room for a floating island.

Big Don

Sr. Grandmaster

Hammer fixes everything

True, but, what you really need is a FUBAR

oftheherd1

Senior Master

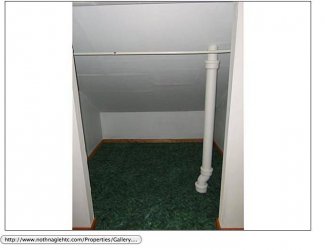

I guess the first photo is your new darkroom, since I see in number 7 that you have a spacious outhouse?

Congratulations on the new home. It looks really nice.

Congratulations on the new home. It looks really nice.

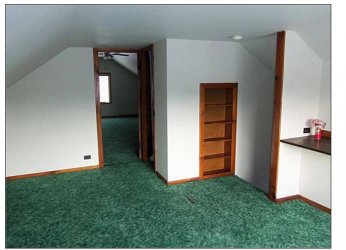

#5 2.5 car garage, with 14 outlets and a high ceiling. Photo Studio.

The outhouse looking things for the lawn mower and snow blower and maybe a model that misbehaves.

The outhouse looking things for the lawn mower and snow blower and maybe a model that misbehaves.

I will offer only a couple paranoid pieces of advice.

1) Buy flood insurance. Traditional homeowners' insurance does not cover flood damage. If you are not in a 100-year floodplain, it's really cheap. And it only takes one flood.

2) Get the rider on your homeowner's police that covers damage due to water damage if it is not present. It's a loophole that many homeowners find out after they have damage due to something like a water drain backup, and find that no one covers it. Bad mojo.

http://www.iinc.org/articles/18/1/Flood-Damage-Vs-Water-Damage/Page1.html

Both can be added to your monthly mortgage payment so they don't bill you separately.

1) Buy flood insurance. Traditional homeowners' insurance does not cover flood damage. If you are not in a 100-year floodplain, it's really cheap. And it only takes one flood.

2) Get the rider on your homeowner's police that covers damage due to water damage if it is not present. It's a loophole that many homeowners find out after they have damage due to something like a water drain backup, and find that no one covers it. Bad mojo.

http://www.iinc.org/articles/18/1/Flood-Damage-Vs-Water-Damage/Page1.html

Both can be added to your monthly mortgage payment so they don't bill you separately.

shihansmurf

Black Belt

2) Get the rider on your homeowner's police that covers damage due to water damage if it is not present. It's a loophole that many homeowners find out after they have damage due to something like a water drain backup, and find that no one covers it. Bad mojo.

Quoted for truth!

I found out about this the hard way a few years ago in AZ. The house I own has a swamp cooler mounted on the roof. The sea;s broke and it overflowed into the attic. $800.00 worth of damage.

I got the rider and wish I had known about it before.

Congrats on the house.

Mark

Last edited:

Had the house inspected, mostly ok. Some concerns with the basement that are looking to be addressed, a leak in the garage that seems to be resolvable, and some electric issues we're negotiating about now.

Quoted for truth!

I found out about this the hard way a few years ago in AZ. The house I own has a swamp cooler mounted on the roof. The sea;s broke and it overflowed into the attic. $800.00 worth of damage.

I got the rider and wish I had known about it before.

Congrats on the house.

Mark

I'm sorry you had uncovered damage. It's a dirty little secret of the insurance industry; they don't insure water damage and they don't tell you (it's in the policy of course, but who reads every line of it?). They'll happily sell you the rider, if you ask for it, and it's not that expensive; but you have to ask. How's that for f'd up?

Empty Hands

Senior Master

I'm sorry you had uncovered damage. It's a dirty little secret of the insurance industry; they don't insure water damage and they don't tell you (it's in the policy of course, but who reads every line of it?). They'll happily sell you the rider, if you ask for it, and it's not that expensive; but you have to ask. How's that for f'd up?

This is one reason I love the internet, it reduces the information asymmetry we consumers normally face. When we started looking at for a house, the internet proved to be a fountain of useful information like that, information you would normally have to find out the hard way. Especially since we are moving to the northeast with an oil/boiler/water heating system and a septic tank, which we have never had before.

Congratulations on the new home, Cap'n - as you say, that wood panelling looks very nice :tup:. And all for the price of a waste-paper-basket-sized flat in the South of England :lol:. My house cost (I won't say is 'worth' because it isn't) three times that and it's a semi-detached next to a dual-carriageway :faints:

This is one reason I love the internet, it reduces the information asymmetry we consumers normally face. When we started looking at for a house, the internet proved to be a fountain of useful information like that, information you would normally have to find out the hard way. Especially since we are moving to the northeast with an oil/boiler/water heating system and a septic tank, which we have never had before.

Underground oil tank? If so, another beware! The EPA is requiring people to dig up their oil tanks at their own expense, and it's not something you can do with a shovel; has to be removed like asbestos, by a trained team. Again, you can purchase insurance against same, but only if you know it and take action before being tagged by the EPA.

Empty Hands

Senior Master

Underground oil tank? If so, another beware! The EPA is requiring people to dig up their oil tanks at their own expense, and it's not something you can do with a shovel; has to be removed like asbestos, by a trained team. Again, you can purchase insurance against same, but only if you know it and take action before being tagged by the EPA.

Nope, above ground, in the basement. Also compliant with Maine's recent law requiring double walled tanks. The leakage issue was another helpful hint we knew going in thanks to the internet.

Dang, I missed that in my own policy. Its up for renewal. Thanks Bill, I'll be taking a closer look at that for sure!

I hope it helps. It's amazing how many things they just don't tell you about. Did you know if you call with policy questions, they can (and do) consider that a 'claim' and uprate you accordingly? We called twice on our auto insurance to see if broken glass was covered (it was, but it cost less than our deductible so we didn't file a claim). Both calls are considered 'claims' and even though we have a new auto insurance company now, they have access to that and we pay more for our 'two claims'. And no, you can't contest that.

http://www.fool.com/personal-finance/home/home-insurance-gotchas.aspx

http://www.dec.ny.gov/chemical/32263.html

Even if your heating oil tank is unregulated, you probably know that a leak could be very unfortunate - not only for the environment, but for your pocketbook too. When an underground tank or pipe leaks, the cleanup can cost $20,000 or more. And if your homeowner's insurance policy contains a "pollution exclusion" clause, which many do, you could get stuck with the bill.

http://www.iinc.org/articles/18/1/Flood-Damage-Vs-Water-Damage/Page1.html

FLOOD INSURANCE

As the name implies, a standard flood insurance policy, which is written by the National Flood Insurance Program, provides coverage up to the policy limit for damage caused by flood. The dictionary defines "flood" as a rising and overflowing of a body of water onto normally dry land. For insurance purposes, the word "rising" in this definition is the key to distinguishing flood damage from water damage. Generally, damage caused by water that has been on the ground at some point before damaging your home is considered to be flood damage. A handful of examples of flood damage include:

A nearby river overflows its banks and washes into your home.

A heavy rain seeps into your basement because the soil can't absorb the water quickly enough

A heavy rain or flash flood causes the hill behind your house to collapse into a mud slide that oozes into your home.

Flood damage to your home can be insured only with a flood insurance policy -- no other insurance will cover flood damage. Flood insurance is available through your insurance agent, insurance company or local Federal Emergency Management Office (FEMA). To determine if your home is located in a flood plain, contact your county planning office. If you are living in a flood plain, flood insurance may be an excellent purchase.

HOMEOWNERS INSURANCE

A homeowners insurance policy doesn't provide coverage for flood damage, but it does provide coverage for many types of water damage to your home. Just the opposite from flood damage, for insurance purposes, water damage is considered to occur when water damages your home before the water comes in contact with the ground. A few examples of water damage include:

A hailstorm smashes your window, permitting hail and rain free access into your home.

A heavy rain soaks through the roof, allowing water to drip through your attic or ceiling.

A broken water pipe spews water into your home.

Even if flood or water damage is not covered by your homeowners insurance policy, losses from theft, fire or explosion resulting from water damage is covered. For example, if a nearby creek overflows and floods your home, and looters steal some of your furnishings after you evacuate, the theft would be covered by your homeowners insurance because it is a direct result of the water damage. However, the flood damage would be covered only if you have flood insurance.

It's important to note that flood insurance and homeowners insurance do not duplicate coverage for water damage. Instead, they complement each other.

It is up to you to talk to your insurance agent or insurance company about flood insurance and homeowners insurance, and then decide which insurance coverage you need to protect your home, its contents and your family.

FYI, in my experience, homeowners insurance does NOT cover water damage, for example due to backed-up drains, etc, unless you purchase a specific rider on your police. ASK YOUR AGENT or you may end up sucking up the water and the cost of the damages yourself.

I know my neighbor in NC got screwed; the water main broke, but it was in her front yard. The city fixed it, but sent her the bill. He sent it to his insurance company and NO DICE they refused to pay. $6,000 she had to eat it herself. Oh, and another $600 to the water company for the water itself.

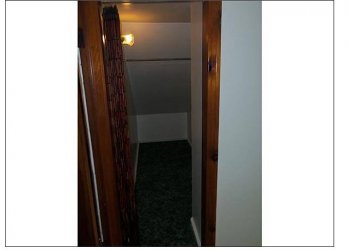

Since the link broke, heres some pics.

I call dibs on the little red shed for where I stay when I come to visit! :~D

granfire

Sr. Grandmaster

I call dibs on the little red shed for where I stay when I come to visit! :~D

Hoping for a misbehaving model in there?

I think that's spoken for. I believe the large spare processing tray in the "Darkroom" is for guests. When not in use, of course.I call dibs on the little red shed for where I stay when I come to visit! :~D

Similar threads

Latest Discussions

-

Qinna/Chin na what are your training experiences?

- Latest: windwalker099

-

-

-

-